Tackling Liquidity Challenge for New Exchanges

The brokerage sector is changing, and companies are facing growing demands to expand their operations while ensuring efficiency, security, and compliance. A crucial element that can assist brokerages in reaching these objectives is an optimized technology stack. Liquidity is essential for any exchange, be it a stock market, cryptocurrency platform, or a local currency market, because of the entire system’s functionality and credibility.

Shallow order books, reliance on a single liquidity source, absence of aggregation and smart routing technologies, inadequate regulatory adherence, poor token choices, and weak risk management practices are the liquidity challenges that new exchanges encounter.

By recognizing these challenges, exchanges can take proactive measures to reduce risks and establish a solid basis for liquidity and growth. These problems can result in liquidity crises, create harm to their reputation, and financial setbacks.

Liquidity in an exchange indicates the ease and speed with which an asset can be purchased or sold without causing major fluctuations in its market price. An exchange with high liquidity features numerous active buyers and sellers, resulting in efficient transactions, stable prices, and a small gap between the highest bid and the lowest ask price.

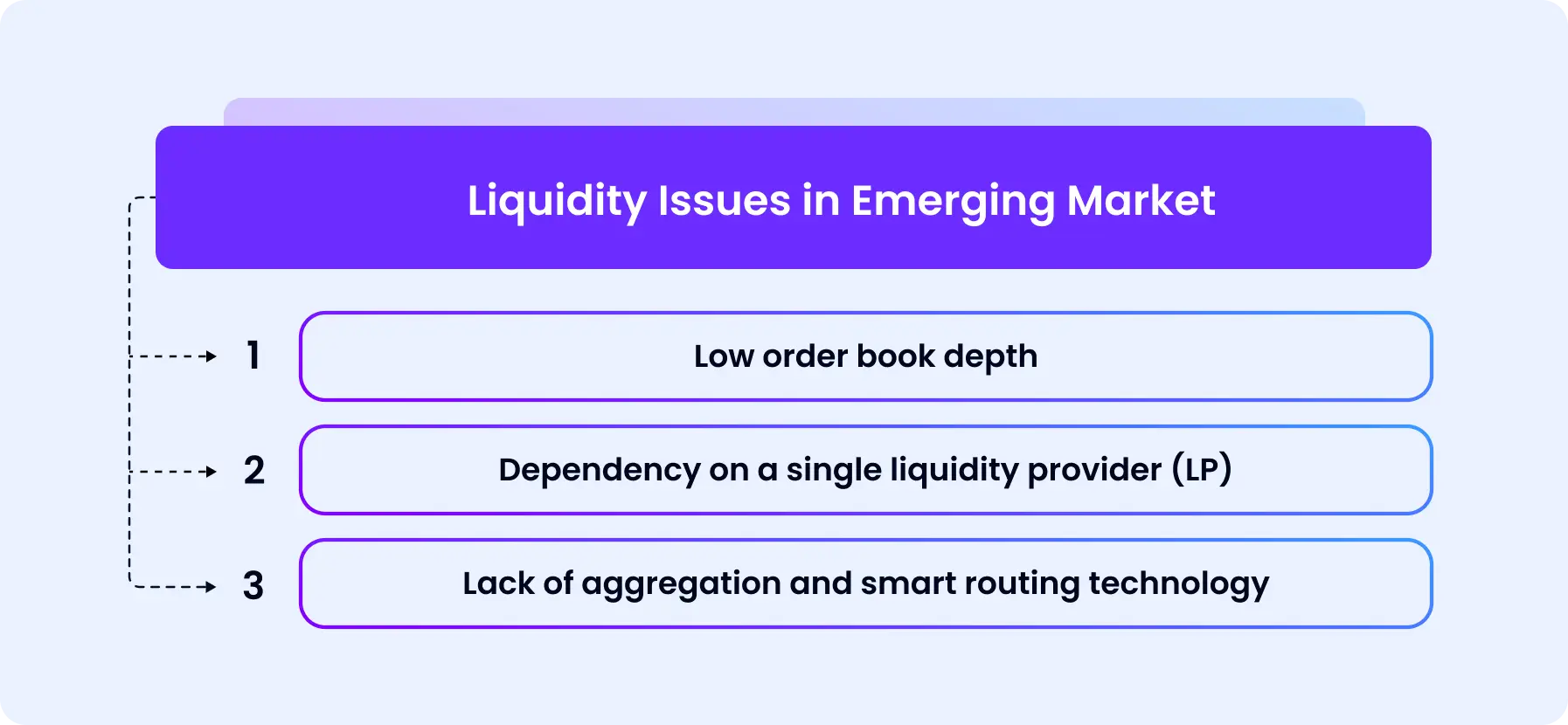

Liquidity Issues in Emerging Market

Low order book depth

This challenge leads to wide spreads and considerable slippage, especially for larger or impactful orders. Limit orders may remain unexecuted for long periods. Low order book depth is a significant and costly liquidity issue for emerging exchanges. Several factors contribute to this challenge; some newly launched exchanges fail to recognize the importance of offering early incentives for liquidity, like maker rebates or volume-based rewards, to encourage market participation.

Dependency on a single liquidity provider (LP)

Poor order execution, increased slippage, and a loss of user confidence would occur because of the reliance on just one liquidity provider (LP), which merges execution, credit, operational, and regulatory risks into a single counterparty.

Problems with the sole LP, such as threats like liquidity shocks, issues with the counterparty’s party’s financial viability, price manipulation, operational failures, regulatory actions, and insufficient liquidity for new listings, result in worse pricing, failed transactions, or trading interruptions on the exchange.

Exchanges are attracted to single LPs because it speeds up their time-to-market, simplifies integration and operations, provides the misconception of immediate liquidity from a large partner, and offers favorable commercial terms that seem cost-effective in the short term. All these entice exchanges, and they fall into trap.

Engaging multiple market makers and OTC desks, blending centralized LPs with on-chain automated market makers (AMMs) and aggregators, creating incentives for local liquidity, and implementing dynamic risk limits for each LP to distribute and manage exposure effectively can help to achieve diversification, which is a combination of commercial and product strategies.

Lack of aggregation and smart routing technology

Liquidity aggregation technology plays a vital role by enabling exchanges to combine feeds from multiple LPs, optimize the mixing of spreads, and intelligently allocate orders based on price and volume availability. One of the most underemphasized liquidity challenges for many new exchanges is the lack of advanced aggregation technology.

Incoming orders are often directed to a single liquidity provider (LP) or a basic price feed, which means they may miss out on better pricing and improved execution opportunities from different sources because they lack strong liquidity aggregation.

Some organizations also overvalue the effectiveness of FIX API routing, smart order routing (SOR), or multi-venue quote blending, which are all important in today’s market. These liquidity challenges frequently occur from budget limitations or the strategic choice to develop simple trading engines that lack aggregation support.

Exchanges can go live in a matter of weeks, scale easily, and access substantial liquidity by aggregating with leading providers. With round-the-clock support and complete branding options, WL Global enables clients to concentrate on growth while managing the technical, regulatory, and operational challenges.

WL Global assists emerging cryptocurrency exchanges in navigating significant obstacles by providing a quick, secure, and customizable white-label platform.

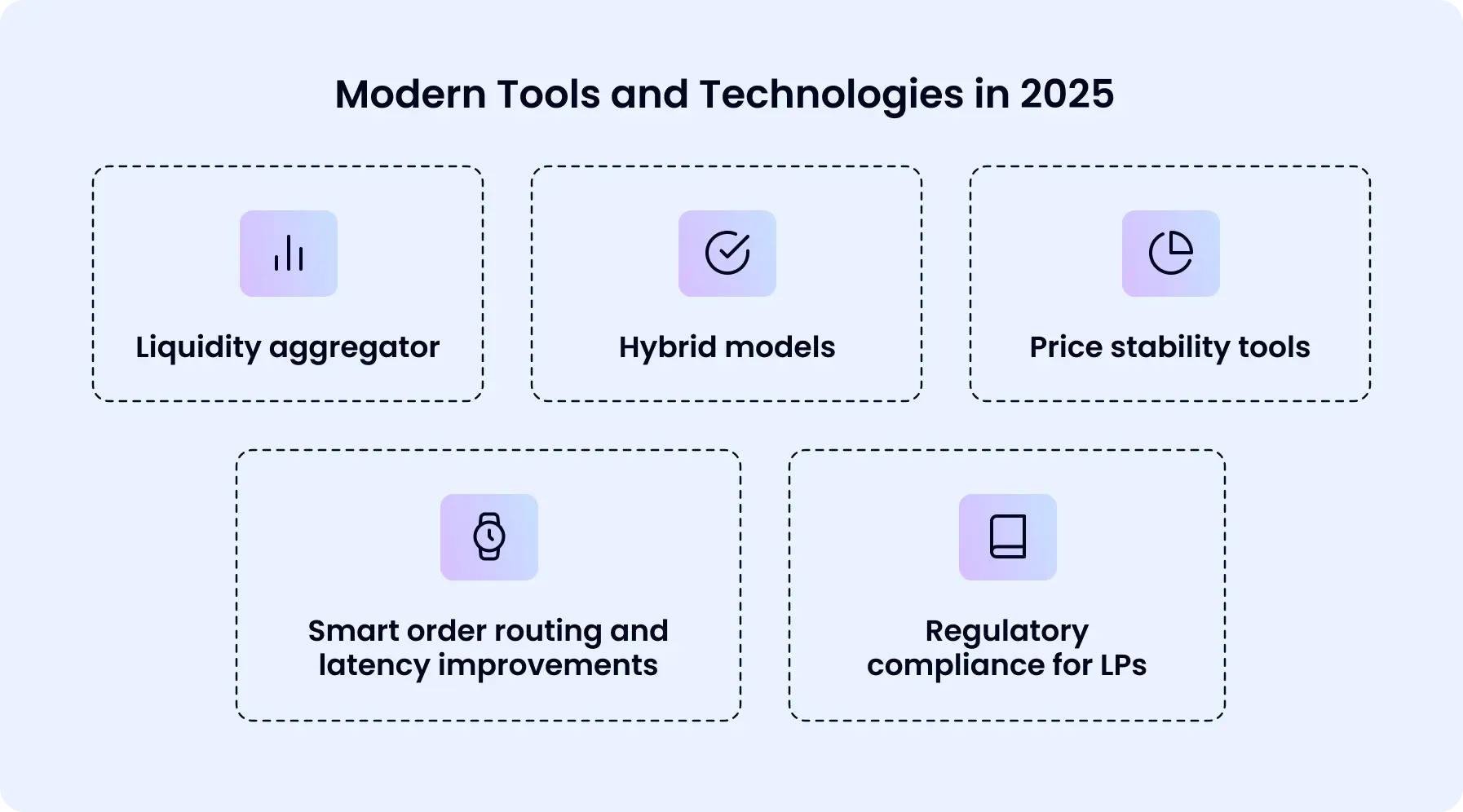

Modern Tools and Technologies in 2025

1. Liquidity aggregator

It functions as a smart intermediary, linking traders and financial institutions to multiple liquidity providers at once. The primary role of liquidity aggregation is to pool liquidity from different sources to create deeper markets and more competitive pricing. The aggregator gathers asset price information from various sources to provide traders with the most advantageous trading prices that closely reflect market conditions.

2. Smart order routing and latency improvements

SOR is a crucial component of decentralized exchange (DEX) aggregators, performing as the foundation that guarantees liquidity and optimal trade execution. Smart order routing is an automated system that evaluates multiple trading platforms to identify the best trading conditions for a specific order.

Latency improvement involves minimizing latency; it is vital as trading activity rises. To ensure quick trade execution, which is essential in high-frequency trading scenarios, advanced algorithms and infrastructure upgrades must be introduced.

3.Price stability tools

Price tools assist in ensuring identical pricing across various platforms and minimize the effects of abrupt market changes, which is essential for traders and liquidity providers. Stability instruments ensuring price stability are created to lessen volatility in the cryptocurrency market.

4.Hybrid models

A hybrid strategy allows platforms to connect into a wider array of liquidity sources and meet various trading requirements. The combination of fiat and cryptocurrency trading is increasing, facilitating smooth transactions between various asset types.

5. Regulatory compliance for LPs

Platforms are establishing strong compliance systems to fulfill these requirements, ensuring they function efficiently in both traditional and decentralized finance sectors. It is becoming crucial for liquidity providers to adhere to regulatory standards in today’s changing financial landscape.

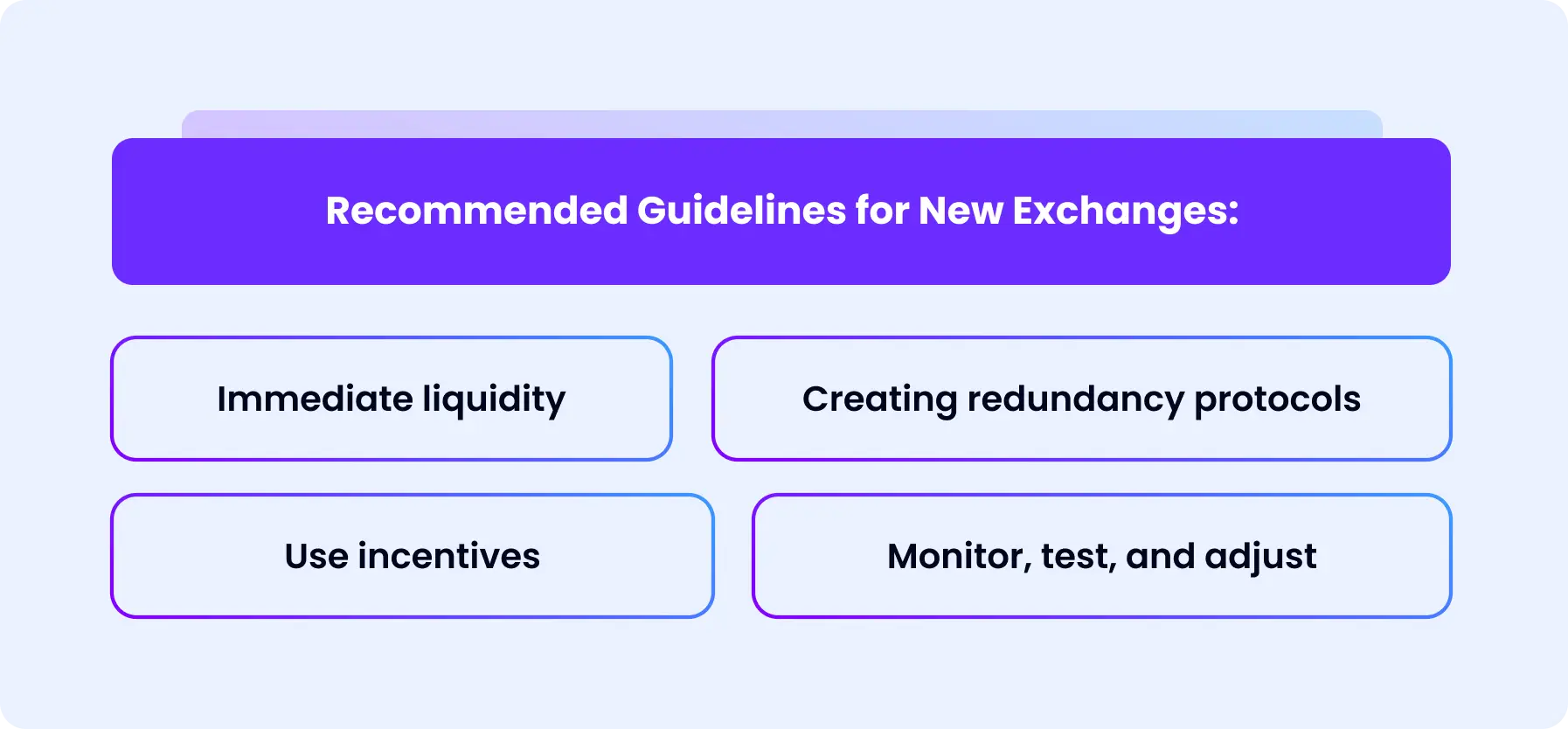

Recommended Guidelines for New Exchanges

1. Immediate liquidity

It is essential to develop a liquidity strategy that outlines target spreads and depth for each instrument right from day 0. It is crucial for leverage cross-exchange routing and arbitrage opportunities to get quick access to external liquidity. Limit the initial range of products to popular options with established demand to enhance liquidity and streamline market making.

2. Creating redundancy protocols

Establish circuit breakers and emergency pause mechanisms at both the instrument and market levels, incorporating human oversight for expansion. Prevent inaccurate or excessive orders from overwhelming the system by employing order validation and throttling measures. The creation of replayable audit log is important to enable the reconstruction of order flow and positions for resolving disputes.

3. Use incentives

Create referral programs to enhance organic user growth. Incentives can be utilized to increase trading volume and offer maker or taker fee rebates to promote liquidity.

4. Monitor, test, and adjust

Key performance metrics should be monitored and tested. Examples are narrow spreads, which indicate strong liquidity; slippage that results in better trade execution, execution time that assist in enabling quick transactions and enhancing the user experience lastly, order book depth that indicate the strength of the market.

Challenges and Risk Management Strategies

Technical challenges

A key challenge is the scalability of infrastructure especially during high transaction volumes or when adding new LPs. Furthermore, latency and performance issues are significant technical challenges particularly in real-time pricing and execution with various liquidity providers (LPs). Implementing edge computing and optimizing content delivery networks (CDNs) can help reduce latency.

Operational challenges

Onboarding LPs can be operationally challenging due to differing levels of technical capability and compliance readiness. Monitoring LP activities helps in detecting and preventing market manipulation tactics. This tool helps in enhancing market integrity but also provides valuable insights for managing risk. Using fallback strategies is essential to maintain liquidity during LP outages or failures.

Regulatory challenges

Ensuring compliance with KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations is a fundamental requirement when working with LPs.

In conclusion, liquidity is essential for building trust and ensuring longevity. New exchanges must focus on liquidity from the beginning in order to develop strong infrastructure and adopt effective risk management as they navigate this complex environment.

FAQ

Q1 : What is liquidity?

A: Liquidity in new exchanges pertains to the ease with which assets can be traded without causing major fluctuations in price.

Q2: Challenges in new exchanges?

A: New exchanges encounter obstacles such as low liquidity, regulatory uncertainties, challenges with technical scalability, and the need to establish user trust in a fast-paced and competitive market.

Q3: What is the risk of relying on a single liquidity provider (LP)?

A: Depending on a single liquidity provider increases the risk of price manipulation, decreases market depth, and threat of service interruptions.