Navigating Regulatory Challenges: Compliance Considerations for Crypto Liquidity Providers

The importance of liquidity providers in crypto cannot be underestimated. As the importance of liquidity in crypto became known, the need for liquidity providers (LPS) grew enormously. As a crypto liquidity provider, it's important to understand not just your role in maintaining liquidity but also the regulatory challenges you might encounter in the crypto world. Hence, in this blog post, we will examine these considerations, and offer insights on ways to navigate these challenges.

Crypto Liquidity Providers Explained

A crypto liquidity provider is an entity, usually a company, that plays an essential role in facilitating trading on the cryptocurrency market. These providers act as a bridge between buyers and sellers, ensuring that there is enough liquidity available to allow trades to be executed smoothly. They serve as the financial backbone of cryptocurrency liquidity, enabling a vibrant and thriving crypto ecosystem.

Crypto liquidity providers play a crucial role in ensuring the availability of a pool of digital assets for trading that market participants can easily buy and sell. This pool, known as a liquidity pool is designed to reduce price slippage, ensuring traders' orders are executed smoothly even in markets with limited liquidity

Liquidity providers also contribute to liquidity by maintaining a constant bid-ask spread. This spread ensures a stable and predictable trading environment for market participants. Automated market makers, a subset of liquidity providers, also play an important role in stabilizing this spread. They constantly update their buy and sell orders to ensure a steady supply of assets, and receive LP tokens in return.

Regulatory Challenges faced by Liquidity Providers and their Impact

However, to exist or continue as a crypto liquidity provider, compliance with regulatory requirements is essential. Government agencies, legal frameworks, and other bodies in a specific jurisdiction impose these requirements.

Specifically, these regulations ensure that liquidity providers have adequate liquidity, protect investors, and maintain market integrity. They also prevent illicit activities such as money laundering, fostering a more secure and stable environment for all participants. Meeting these requirements may be challenging, but not impossible. Let us take a look at these challenges, and in turn, strategies you can put in place to ensure you comply with them.

1. Inconsistent regulatory frameworks across jurisdictions.

Many countries lack clear cryptocurrency regulations, creating uncertainty about compliance requirements for liquidity providers. This uncertainty can make it difficult to stay within legal boundaries.

An example is the lack of a universally accepted classification for the use of crypto assets and smart contracts.

Another example is how regulatory frameworks typically use different terms for payment tokens. Japan and the United Kingdom use "stablecoin". The UK government decided to use the term "stablecoins" while the Japanese framework uses "digital-money type stablecoins".

The term "tokens" is also used differently in the EU, UAE, and the United States.

The US authorities use the term "dollar tokens," EU co-legislators use the term "e-money tokens," and the UAE focuses on "fiat crypto tokens".

These inconsistencies pose significant challenges for liquidity providers because cryptocurrency is global rather than domestic.

Galaxy Digital Trading, one of the top liquidity providers, reported a 54% decline in revenue in 2022 due to low liquidity and regulatory uncertainty.

Liquidity providers in China were also affected by an inconsistent regulatory framework in 2017, when Initial Coin Offerings (ICOs) were banned and domestic cryptocurrency exchanges were closed.

This demonstrates the importance of a consistent regulatory framework in preventing regulatory arbitrage and a fragmented regulatory environment, which can undermine financial stability.

2. AML/KYC Compliance.

Financial criminals frequently target financial institutions for money laundering activities, and liquidity providers are no exception. Money laundering risks jeopardize liquidity providers' reputations; thus, compliance with regulations such as Know Your Customer (KYC) and Anti-Money Laundering (AML) is critical to mitigate the risks posed by money laundering activities. However, the complexity of some crypto's pseudonymous nature also makes it difficult for liquidity providers to ensure compliance with these regulations.

Despite this, noncompliance with the regulations has serious consequences. These include reputational damage, imprisonment, financial losses, restricted access to financial services, and international sanctions, among others.

One notable case is BitMEX, a major crypto derivatives exchange whose trading activities significantly impacted market liquidity.

In 2020, the United States Commodity Futures Trading Commission (CFTC) charged BitMEX and its founders with violating AML/KYC laws. They were accused of allowing US customers to trade on its platform without proper KYC checks.

As a result, BitMEX faced US criminal charges and a $100 million fine. In addition, the company's founders faced criminal charges. This severely harmed BitMEX's reputation and eroded user trust, resulting in a decline in market share and trading volumes.

3. Licensing and Registration.

The requirements for licenses or registrations to operate as a liquidity provider vary greatly between jurisdictions. Obtaining the required permits can be time-consuming and costly.

For example, in the United States, licensing and registration requirements vary by state. Jump Trading is a high-frequency trading firm that provides liquidity in various financial markets, including cryptocurrencies. It serves as an example of a liquidity provider dealing with registration and licensing issues in multiple states.

They encountered registration and licensing challenges as it expanded its operations across multiple states in the United States. The same can be said for other liquidity providers who face complexities and challenges related to multi-state registration and compliance while attempting to provide liquidity in the cryptocurrency space.

Now, let us take a look at some of the strategies you can put in place to ensure compliance with these regulations.

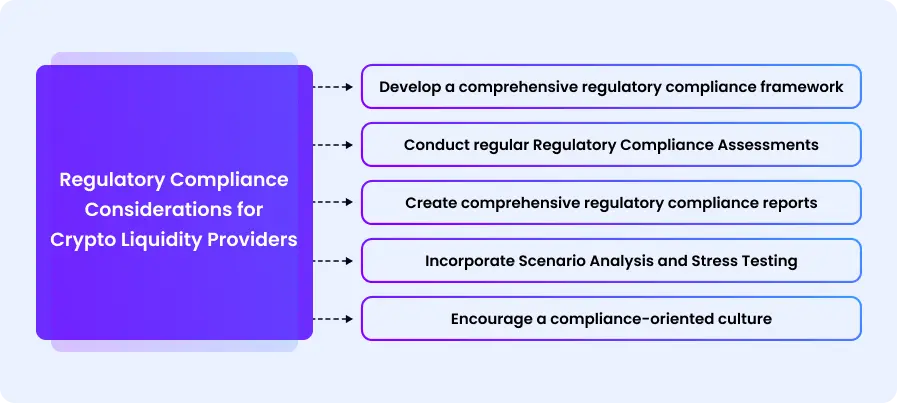

Regulatory Compliance Considerations for Crypto Liquidity Providers

1. Develop a comprehensive regulatory compliance framework.

As a crypto liquidity provider, you must establish a strong framework that is compliant with regulatory standards and industry best practices. This framework should include clear policies, procedures, and risk tolerance levels. It should also encompass liquidity risk metrics and stress testing scenarios to ensure compliance with all applicable regulatory requirements. This includes those related to the order book and trading fees.

2. Conduct regular Regulatory Compliance Assessments.

You should conduct regular assessments to identify potential compliance gaps, assess the effectiveness of their measures, and promptly address any vulnerabilities. This includes analyzing current and projected cash flows, running stress tests, and identifying areas for regulatory compliance improvement.

3. Create comprehensive regulatory compliance reports.

Comprehensive regulatory compliance reports help provide a holistic view of your adherence, combining quantitative metrics with qualitative insights. It is important to note that key regulatory indicators, such as AML/KYC compliance and transaction reporting, must be included in this report. Qualitative data on compliance strategies and contingency plans should also be included to provide a comprehensive overview.

4. Incorporate Scenario Analysis and Stress Testing.

By simulating various regulatory scenarios, you are able to identify potential vulnerabilities and assess their impact on compliance measures. For example, during testing, you may assess the impact of sudden regulatory changes or increased scrutiny on your frameworks. This will help you foresee the actions you can take now to prevent the potential impact.

5. Encourage a compliance-oriented culture.

As a crypto liquidity provider, you should always be in contact with regulatory experts. Collaborate with them and promote open communication at all levels. Also, in an organization setting, it is important to provide regular training programs to increase employees' awareness and understanding of their roles in maintaining regulatory compliance.

A Global Look at Regulatory Frameworks for Crypto

A global regulatory framework for cryptocurrency has yet to emerge from today's patchwork of regulatory guidelines. To date, the regulatory focus has primarily been on anti-money laundering (AML), know-your-customer (KYC), and regulatory permissions regimes. KYC considerations are a high priority, given that crypto asset owners are 'identified' using cryptographic addresses, which make it difficult to determine who owns what in today's cryptocurrency ecosystem.

However, the importance of broad cooperation and coordination at the national and international levels should not be underestimated. This is critical for addressing the risks associated with crypto assets and their markets. The recent volatility in crypto markets emphasizes the critical need for rapid and global implementation of international standards.

Cryptoassets' inherent global nature facilitates regulatory and supervisory arbitrage. Jurisdictions cannot fully mitigate their risks while remaining vulnerable to cross-border weaknesses and inconsistencies. A unified framework for regulating crypto assets and related services is crucial for mitigating associated risks, alongside consistent implementation of international standards.

Final Thoughts

Your journey includes navigating regulatory challenges, and constantly adapting to regulatory frameworks and changes. However, you do not need to walk on this journey alone. As part of our commitment, we offer crypto exchange software that works in any regulation.

To learn about aggregating liquidity independently on terms that are favorable to you

Contact usFAQs

Q1: What are the primary regulatory challenges confronting crypto liquidity providers?

Crypto liquidity providers face numerous challenges, including inconsistent regulatory frameworks across jurisdictions, AML/KYC compliance, and registration and licensing issues.

Q2: How does non-compliance affect the operations of liquidity providers

Noncompliance with regulatory frameworks has a wide range of consequences for liquidity providers, including reputational damage, imprisonment, financial losses, restricted access to financial services, and international sanctions, among others.

Q3: How can liquidity providers keep up with evolving regulatory frameworks?

Liquidity providers can stay up to date on evolving regulatory frameworks by regularly monitoring government agency updates, engaging with industry associations, collaborating with legal experts, attending industry events/webinars, utilizing regulatory intelligence tools, tracking global regulatory trends, networking with peers, and reviewing compliance procedures on a regular basis.